Allow me to introduce a new economic indicator. It doesn’t come from a government agency. Nor is it the creation of a right or left leaning think tank. In a land of indices and measures, there is so little attention to this problem that I had to create the measure myself.

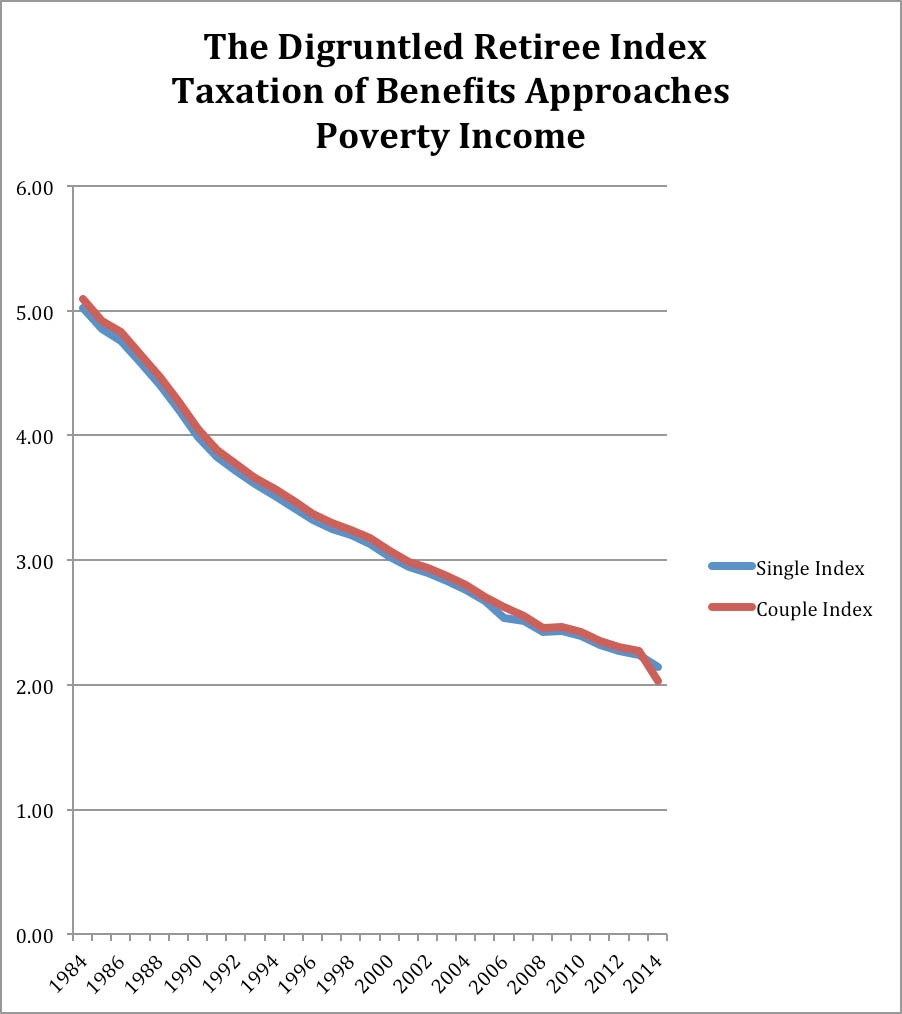

I call it the Disgruntled Retiree Index. To provide it with some academic stature, I’ve added the inevitable colon and provided a formal name. It is the “Disgruntled Retiree Index: The Social Security Benefit Taxation Ratio.” It measures the ratio of the income at which benefits are subject to taxation to the poverty line for the same household size.

It will be a good predictor of retiree dissatisfaction, now and in the future. The lower the ratio, the greater the disgruntle.

The issue here is the ever-lower income at which our government begins to tax Social Security benefits. They were never supposed to be taxed. The tax falls directly on the retirement saving and middle class security that both parties say they support.

The taxation of Social Security benefits was built into the 1983 reforms of Social Security like a bomb with a long fuse. Few people paid any tax when the law went into effect because the threshold for taxation was high. It was set at $25,000 for a single person and $32,000 for a retired couple. Back then, fewer than 3 percent of all retirees paid any tax on their benefits. (Note: the income figures include one-half of Social Security benefits, so the actual income threshold is higher.)

But that was then.

Unlike almost everything else in our tax code, the threshold figures are not indexed to inflation. So the taxation of benefits starts at the same $25,000 or $32,000 levels today as it did in 1984. As incomes have inflated, it has increased the number of retirees who pay taxes on their benefits. According to the Social Security Trustees, about 30 percent of all retirees now pay some amount of taxes on their benefits.

Indexed to inflation, the threshold incomes would now be nearly $59,000 for a single person and $73,000 for a couple.

This is not a tiny tax. It makes a difference. For some middle-income retirees, the tax may double their tax bill over what they would otherwise have paid. It is a big deal. And as I have pointed out in other columns, the heaviest burden falls on middle-income retirees.

So lets measure the injustice of this tax. We can do that by comparing it to the “poverty line.” This is the level of income at which a household is living in poverty. Back in 1984 the poverty line income for people 65 and over was $4,979 for a single person and $6,282 for a couple.

We can get a relative measure by dividing those figures into the threshold for taxing Social Security benefits. Do that and retirees needed income about 5 times the poverty line to be subject to taxation of their benefits back in 1984.

But things change.

In 2014 the poverty line income was $11,670 and $15,730 for a single person or couple, respectively. As a result, benefit income over 2.14 (single) or 2.03 (couple) times the poverty line was subject to taxation. Today, retirement incomes that are only twice the official poverty level can be subject to the tax.

I don’t think that’s right. I bet you don’t, either.

But wait, it gets worse. This tax is only going in one direction. More retirees will pay more taxes. And they will pay it at ever-lower levels of income.

Consider the likely future. It may take 25 years for the ratio to approach one. When that happens, benefit taxation begins precisely when retirement income rises above the poverty level.

Are you 40 or younger? You’ll start paying taxes on your benefits if your retirement income manages to exceed the poverty line. That’s why this isn’t just a problem for old folks. Let’s hope the young are more effective at getting a response from Congress than their elders have been.

It’s good to remember that this little tweak of taxation enjoyed broad, bi-partisan support. It has also survived all attempts to fix it for 30 years.

Graphic:

Want to learn more? Here are links to earlier columns about the taxation of Social Security benefits:

Scott Burns, “The Stealth Tax on Retiree Income,” 2/21/2014

Scott Burns, “Means Testing Social Security,” 1/11/2013

Scott Burns, “The Incredible Importance of Social Security,” 9/6/2013

Scott Burns, “The Little Middle Class Tax That Keeps On Rising,” 8/18/2012

Scott Burns, “Two Candidates With A Nasty Secret,” 10/10/08

Scott Burns, “How the Tax Torpedo Hits,” 2/11/2003

Scott Burns, “The Retiree Tax,” 8/13/2000

On the web:

Historical Poverty figures: https://nlsinfo.org/content/cohorts/nlsy79/other-documentation/codebook-supplement/nlsy79-appendix-2-total-net-family-3#1984

2014 Poverty Guidelines: http://aspe.hhs.gov/poverty/14poverty.cfm

Photo by Andrea Piacquadio from Pexels

(c) A. M. Universal, 2016